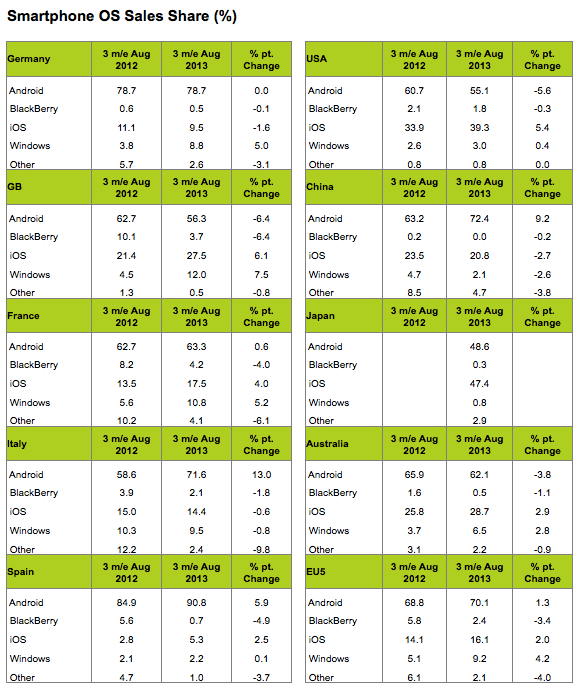

With Apple in the middle of its first month of sales of two new iPhone models, the latest figures out from Kantar Worldpanel, a market research division of WPP, indicates that going into September, sales of Android smartphones are the strongest they have ever been. In the last 12 weeks ending August 31, smartphones running on Google’s mobile OS accounted for over 70% of all sales across the five biggest markets in Europe (UK, Germany, France, Spain and Italy), with corresponding rises in all other major markets surveyed, including the U.S., compared to last month.

However, a look at the bigger picture highlights another trend, and an opportunity for the likes of Apple, Nokia and Android OEMs who are not called Samsung. In key leading markets surveyed â€" U.S., UK and Australia â€" the share of sales to Android are down over a year ago (respectively now at 55.1%, 56.3% and 62.1%). And specifically, the analysts note that Samsung has seen a “dip†in sales for a couple of reasons: market saturation in mature markets; and competition from others at the lower end.

After years of increasing market share, Android has now reached a point where significant growth in developed markets is becoming harder to find,†writes Dominic Sunnebo, director of research at the group. “Android’s growth has been spearheaded by Samsung, but the manufacturer is now seeing its share of sales across the major European economies dip year on year as a sustained comeback from Sony, Nokia and LG begins to broaden the competitive landscape.â€

Important to note that right now Android and Samsung are at a high-enough marketshare that even dips in specific markets are not doing much to tip the balance overall. In Spain, for example, over 90% of smartphones sold in the last 12 weeks were Android handsets. In China the figure is over 72%.

We have reached out to Kantar analysts to see if they can give us data on Samsung’s current share of sales, and whether they can provide any early indications on what kind of an impact the new iPhone models are having on the market. (We’ll update when / if we get more data.)

Targeting bargain hunters

People have remarked a lot about how the new 5c version of the iPhone is not the budget device everyone had been expecting from Apple (although it is priced at a discount to the premium 5s model). So, notwithstanding the fact that the iPhone 4S is now seeing bargain (and often free) bundling with mobile contracts, this will leave the field open to other players who are targeting the “budget†smartphone market â€" that is, users in both developed and emerging markets that are more price-conscious.

So far, Nokia’s aim of developing handsets to meet that latter demand has been paying increasing, if not huge, dividends, Kantar notes. It says that Windows Phone sales, as led by Nokia, are now in double digit percentages in the UK and France, at 12% and 10.8% respectively, with its share of sales in Europe’s five biggest markets at 9.2%. But other important markets like the U.S. (3% of sales) and China (2.1%) remain huge challenges for both Microsoft and Nokia on the mobile front. All things relative, it is still overall doing better than BlackBerry, which is now down to 0% of all sales in China, 1.8% in China, and nothing over 4.2% in any other market.

Judging by the numbers, it looks like Nokia’s and Microsoft’s best bet would be to keep going for bargain hunters or those who are less inclined to buy premium-priced handsets, which interestingly tap into two quite different demographics. “Windows Phone’s latest wave of growth is being driven by Nokia’s expansion into the low and mid range market with the Lumia 520 and 620 handsets,†writes Sunnebo. “These models are hitting the sweet spot with 16 to 24 year-olds and 35 to 49 year-olds, two key groups that look for a balance of price and functionality in their smartphone.â€

Apple’s opportunity

While Kantar doesn’t give any indicators on early iPhone sales, we already know from Apple that sales of the two new models topped 9 million for the opening weekend, compared to 5 million for the iPhone 5 release last year. They haven’t released any numbers yet, but Kantar’s analysts hint that this is a good indication of more sustained strong sales figures for Apple. “This is set to spike in the coming months with the release of the iPhone 5s and 5c,†Sunnebo writes.

For the three months that ended August 31, Apple accounted for nearly 40% of sales in the U.S., up nearly six percentage points over a year ago but down by over three percentage points on last month’s figures (perhaps because of anticipation over the new models). At the time, the new phones could see Apple pulling ahead of Android for the first time in a while. In Japan, Apple’s iOS was nearly level with Android going into September, at 48.6% versus 47.4%, but the phones are now going to be sold for the first time by the country’s largest carrier, NTT DoCoMo, and that “makes it likely that Apple will pull ahead of Android in this key market.â€

Kantar is an insight, information and consultancy network. By uniting the diverse talents of its 13 specialist companies, the group aims to become the pre-eminent provider of compelling and inspirational insights for the global business community. Its 26,500 employees work across 95 countries and across the whole spectrum of research and consultancy disciplines, enabling the group to offer clients business insights at each and every point of the consumer cycle.

April 1, 1976

NASDAQ:AAPL

Started by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple has expanded from computers to consumer electronics over the last 30 years, officially changing their name from Apple Computer, Inc. to Apple, Inc. in January 2007. Among the key offerings from Apple’s product line are: Pro line laptops (MacBook Pro) and desktops (Mac Pro), consumer line laptops (MacBook Air) and desktops (iMac), servers (Xserve), Apple TV, the Mac OS X and Mac OS X Server operating systems, the iPod, the...

September 7, 1998

NASDAQ:GOOG

Google provides search and advertising services, which together aim to organize and monetize the world’s information. In addition to its dominant search engine, it offers a plethora of online tools and platforms including: Gmail, Maps, YouTube, and Google+, the company’s extension into the social space. Most of its Web-based products are free, funded by Google’s highly integrated online advertising platforms AdWords and AdSense. Google promotes the idea that advertising should be highly targeted and relevant to users thus providing...

Samsung is one of the largest super-multinational companies in the world. It’s possibly best known for its subsidiary, Samsung Electronics, the largest electronics company in the world.

1865

August 7, 1994, NYSE:NOK

NOKIA is a Finnish multinational communications corporation. It is primarily engaged in the manufacturing of mobile devices and in converging Internet and communications industries. They make a wide range of mobile devices with services and software that enable people to experience music, navigation, video, television, imaging, games, business mobility and more. Nokia is the owner of Symbian operation system and partially owns MeeGo operating system.

April 4, 1974

NASDAQ:MSFT

Microsoft, founded in 1975 by Bill Gates and Paul Allen, is a veteran software company, best known for its Microsoft Windows operating system and the Microsoft Office suite of productivity software. Starting in 1980 Microsoft formed a partnership with IBM allowing Microsoft to sell its software package with the computers IBM manufactured. Microsoft is widely used by professionals worldwide and largely dominates the American corporate market. Additionally, the company has ventured into hardware with consumer products such as the Zune and...

which would spin like juke boxes to transfer the item in question into the tote, the entire process would rinse and repeat until the order was completed and integrated at the shipping dock. Additional real-time inventory management algorithms would make sure that if a customer ordered milk on the website, it was currently in stock; software algorithms would route delivery vans to multiple delivery stops while minimizing drive time; and software on Palm Pilots in drivers’ hands would deal with real-time delivery confirmation or returns.Â

which would spin like juke boxes to transfer the item in question into the tote, the entire process would rinse and repeat until the order was completed and integrated at the shipping dock. Additional real-time inventory management algorithms would make sure that if a customer ordered milk on the website, it was currently in stock; software algorithms would route delivery vans to multiple delivery stops while minimizing drive time; and software on Palm Pilots in drivers’ hands would deal with real-time delivery confirmation or returns.

Who is Jeff Bezos? I try to break the ice at one point by saying my wife is having trouble with her diaper subscription. We get a box of diapers monthly through Amazon and she’s been getting them in the middle of the month. I ask if he could handle some customer support and get that changed.

Who is Jeff Bezos? I try to break the ice at one point by saying my wife is having trouble with her diaper subscription. We get a box of diapers monthly through Amazon and she’s been getting them in the middle of the month. I ask if he could handle some customer support and get that changed.