Editor’s note: Matt Turck is a managing director of FirstMark Capital. Follow him on Twitter at @mattturck.

Almost 15 years ago, a friend of mine at McKinsey spent a few nights writing a document called “The Battle for the Homeâ€. The thesis at the time was that with broadband, the home PC was gradually going to challenge the TV as the core home digital system. Over the following few years, that battle gradually grew more complex, as the home saw the adoption of a new generation of HDTV sets, game consoles, set-top boxes and DVR options. But fundamentally, the discussion was about who was going to control the home entertainment system.

Now, the battle has expanded to the rest of the home. With the emergence of connected devices, the entire home is being reinvented as a data product, opening great opportunities to entrepreneurs. Â A whole new generation of startups is rushing in. Nest, with its beautifully-designed home products, has become the poster child for this phenomenon, but many others are producing exciting new connected devices and platforms, at an outstanding pace.

The irony of this market, not always acknowledged, is that a number of large companies with big brands and existing “pipes†in our homes, have been unusually innovative. From connected locks to mobile-controlled home automation platforms, large companies such as GE, Comcast or Philips have been offering connected home products for a while now, sometimes at the risk of cannibalizing their own analog products. As a result, the new wave of connected home startups finds itself in the fairly unusual position of having to not only execute and build consumer brands, but also out innovate dynamic incumbents. The home is once again at the crossroads of a major battle between startups, cable companies, telcos, industrial conglomerates, and large technology companies.

As VC money is starting to pour into the space (SmartThings, August and Arrayent all announced significant rounds just in the last two weeks, as did Quirky, as part of an increased focus on the Internet of Things), a new battle for the home is heating up between startups, cable companies, telcos, industrial conglomerates, and large technology companies.

The first battle for the home was not always kind to startups. Many found that, once past the sheer difficulties of building a hardware product, consumers often preferred the convenience of package deals offered by cable companies to best-of-breed point solutions, resulting in many failures or tepid exits.

While this new generation of startups has an exciting opportunity in front of it, the path to success will also be narrow. To succeed long term, startups will need to maneuver shrewdly among the giants in the space, and do what startups do best: deliver truly ground breaking products, build developer networks, bet on openness and interoperability, and leverage data in innovative ways.

The new household brands

There are plenty of reasons to be excited about the emergence of new connected home startups. For reasons I discussed in an earlier post, there’s been an explosion of activity in the space, initially financed by crowdfunding and now increasingly by institutional money â€"  SmartThings and August, for example, both just announced large Series A rounds. Each category is seeing rapid innovation: thermostats (Nest), locks (August, Lockitron), security (Canary, Doorbot), lights (LIFX), home automation (SmartThings, Zonoff, Ninja Blocks, Ube, Berg, Twine, Xively, etc.), garden products (Bitponics, Click & Grow), bathroom appliances (Withings), nursery products (Sproutling, in which I’m an investor), and many others.

This is a big opportunity. Beyond the fact that it’s already a significant market ($13 billion, say some estimates), connected home entrepreneurs have an opportunity to create, quite literally, new household brands. The emergence of connected devices is one of those disruptive waves that define entire new product categories. Consumption habits change and reform around a handful of brands that become leaders in the space. Some wonder why smart and ambitious entrepreneurs are scrambling to build products in those seemingly mundane home categories; in fact, those entrepreneurs are attracted like heat-seeking missiles by the opportunity to build category-defining brands. At the current pace, this window of opportunity may not last more than a couple of years, and successful first movers will have a strong brand advantage.

Clearly, the adoption of those connected home products is still largely the province of hobbyists and tech enthusiasts. Interestingly however, large retailers seem to be excited about distributing those products to their mainstream audiences.  Many entrepreneurs I speak with report engaging with some of the biggest players, such as Home Depot, Lowe’s, Staples, Apple stores and AT&T.

While this is not a recipe for long-term success, there’s an element of self-fulfilling prophecy here, where the combination of entrepreneurial energy, investor money and retailer interest could lead to rapid growth for the connected home startups.

Not so fast

However, for all the enthusiasm on crowdfunding platforms and in the press, this is already a crowded space. Many of the existing players are large companies that come equipped with deep distribution networks and a whole ecosystem of service providers that make a living installing and maintaining their products.

First, there are all the incumbents, both in home and energy automation (Crestron, Lutron, Control4, etc) and home security (ADT, Protection 1, Vivint, etc.). Not the most exciting brands? Perhaps.

Second, many large industrial companies have already launched their own connected home products â€" think, for example, Yale’s Z-Wave deadbolt or the Philips Hue, a smartphone-controlled LED bulb. There are many other examples.

Third, the cable providers and telcos increasingly view home automation as a strategic priority. Comcast (Xfinity), Time Warner Cable, Cox, AT&T and Verizon (FiOS) all have solutions for anything from thermostat and light control to security, accessible through mobile apps.

Last but not least, the large technology companies Apple and Google are already de facto active in the space, as the mobile phone has become the remote control for the connected home. They may want to go deeper. Google’s “Android @Home†effort seems to have faltered so far, but Chromecast is intriguing. Apple is rumored to be interested in the space at the highest level of the organization, and actively meeting with startups. It has been suggested that they should acquire Nest to enter the space and re-acquire the Apple-bred talent there. Microsoft (Kinect), Samsung and HTC all have existing or emerging efforts.

Dancing with the giants

So what’s a startup to do? For those ambitious startups that are gunning for a central position in the connected home, the question is what strategy gets you there faster

One key choice is whether to go “product first†(build a consumer product, like Nest) or “platform first†(build a platform that connects all products, like Revolv). The former involves more hardware, but arguably offers a better chance of gaining rapid sales traction if the product delivers. It is also less of an immediate challenge to most of the large companies in the space. The path to control of the home involves releasing multiple products that connect to one another (which Nest is starting to do with its Protect smoke alarm), and eventually become a platform.

The “Platform First†strategy is more of a software play, and its core value proposition is home automation. It offers strong long term defensibility if you get there, but the journey is fraught with difficulties. First, as Lowe’s has learned with Iris and Schlage with Nexia, it is difficult to get consumers to buy and install a “hubâ€. In addition, among the early adopters that are likely to do so, a non-trivial portion are Arduino and Raspberry Pi aficionados that prefer to hack their own system.  For mainstream adoption, one avenue for platform players could be to work with home developers and gradually get their systems included in new construction, obviously a long process.   Second, the Platform strategy places startups in direct competition with Comcast, Verizon FiOS and many other large companies that are also vying to become the hub for the automated home, and already have millions of customers. The bet here for “Platform First†players is that, by promoting openness and interoperability in a way that is harder for large companies to do, they can build a strong network of developers that write to the platform â€" perhaps starting with hobbyists and the smaller “Product first†companies that need help competing with the “Product first†leaders â€" the benefit for the customer being that they will be able to connect all their best-of-breed point solutions.

Another key choice, particularly for “Platform First†players, is whether to go consumer (develop your own brand) or enterprise (be an enabling technology for other brands).  Some solid companies have chosen the latter, such as iControl Networks (which powers Comcast’s Xfinity and others) or Zonoff (which powers Staples Connect). Others like SmartThings have been building a recognizable brand in the space, which some large companies could perceive as a threat. My sense is that eventually most startups will need to work with the large companies in some capacity to be successful, so perhaps the question is what strategy puts you in the best negotiating position for a partnership (or an acquisition).

Seven Key Characteristics

Beyond positioning, connected home startups will need to combine several characteristics to build long term value and defensibility. Here is my list of seven.

- Design quality is hugely important in transforming those trivial products into objects of desire, and to succeed connected home startups will need to be true “design nativesâ€: Nest, August and Canary are great examples of design done right.

- Simplicity of installation and usage will be essential: little effort in, maximum return out.

- Mission criticality and strong ROI are key in a space where some products could easily be mistaken for nice to have “gadgetsâ€: security, health and energy are great categories from that perspective.

- In the same vein, startups will need to deliver real innovation. Simply adding connectivity to a home product doesn’t make it great. Is the connected product 10X better than its analog equivalent? Or, even better, does it simply not have an analog equivalent?

- A multi-product vision and the ability to release successful products back to back will be crucial in building self-standing, long-term successes in the space â€" obviously, easier said than done.

- Software openness and interoperability will be necessary to successfully build developer networks and partnerships.

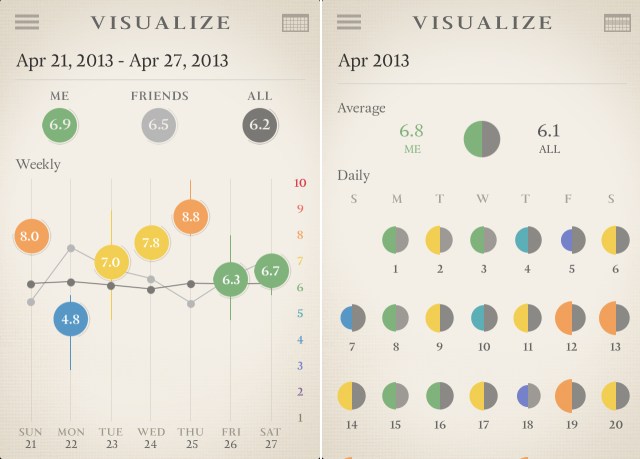

- Perhaps most importantly, startups will need to be true “data nativesâ€. Many connected devices offer exciting opportunities to build “data network effectsâ€:  each device captures data that, aggregated and analyzed at the cloud level, enables the extraction of insights that in turn make each individual device smarter, through machine learning and predictive analytics. This is one of the main reasons why the Internet of Things goes much beyond a simple hardware play, and will be a key aspect of the defensibility of the winners in the space: you pay for the hardware, but the software (and data) is what keeps you using the product.

This new battle for the home is just getting started. It will have many twists and turns, and I’m very excited to see how it all unfolds.

Additionally, this will not be the end of video-game right-of-publicity litigation. Video games are a fertile ground for such litigation. Just two years ago, in the No Doubt v. Activision case, the band No Doubt prevailed on a right-of-publicity claim against Activision from the

Additionally, this will not be the end of video-game right-of-publicity litigation. Video games are a fertile ground for such litigation. Just two years ago, in the No Doubt v. Activision case, the band No Doubt prevailed on a right-of-publicity claim against Activision from the