A hearse rolls up to a Yahoo bus at the BART MacArthur Station in Oakland. A protester who had climbed on top of the bus later vomited on the vehicle. (From Indybay)

The Santa Clara Valley was some of the most valuable agricultural land in the entire world, but it was paved over to create today’s Silicon Valley. This was simply the result of bad planning and layers of leadership failure â€" nobody thinks farms literally needed to be destroyed to create the technology industry’s success.

Today, the tech industry is apparently on track to destroy one of the world’s most valuable cultural treasures, San Francisco, by pushing out the diverse people who have helped create it. At least that’s the story you’ve read in hundreds of articles lately.

It doesn’t have to be this way. But everyone who lives in the Bay Area today needs to accept responsibility for making changes where they live so that everyone who wants to be here, can.

The alternative â€" inaction and self-absorption â€" very well could create the cynical elite paradise and middle-class dystopia that many fear. I’ve spent time looking into the city’s historical housing and development policies. With the protests escalating again, I am pretty tired of seeing the city’s young and disenfranchised fight each other amid an extreme housing shortage created by 30 to 40 years of NIMBYism or (“Not-In-My-Backyard-ismâ€) from the old wealth of the city and down from the peninsula suburbs.

Here is a very long explainer. Sorry, this isn’t a shorter post or that I didn’t break it into 20 pieces. If you’re wondering why people are protesting you, how we got to this housing crisis, why rent control exists or why tech is even shifting to San Francisco in the first place, this is meant to provide some common points of understanding.

This is a complex problem, and I’m not going to distill it into young, rich tech douchebags-versus-helpless old ladies facing eviction. There are many other places where you can read that story.

It does us all no justice.

1) First off, understand the math of the region. San Francisco has a roughly thirty-five percent homeownership rate. Then 172,000 units or the city’s 376,940 housing units are under rent control. (That’s about 75 percent of the city’s rental stock.)

Homeowners have a strong economic incentive to restrict supply because it supports price appreciation of their own homes. It’s understandable. Many of them have put the bulk of their net worth into their homes and they don’t want to lose that. So they engage in NIMBYism under the name of preservationism or environmentalism, even though denying in-fill development here creates pressures for sprawl elsewhere. They do this through hundreds of politically powerful neighborhood groups throughout San Francisco like the Telegraph Hill Dwellers.

Then the rent-controlled tenants care far more about eviction protections than increasing supply. That’s because their most vulnerable constituents are paying rents that are so far below market-rate, that only an ungodly amount of construction could possibly help them. Plus, that construction wouldn’t happen fast enough â€" especially for elderly tenants.

So we’re looking at as much as 80 percent of the city that isn’t naturally oriented to add to the housing stock.

Oh, and tech? The industry is about 8 percent of San Francisco’s workforce.

Then if you look at the cities down on the peninsula and in the traditional heart of Silicon Valley, where home-ownership rates are higher, it’s even worse.

The true culprit behind our housing problems: let us deflect blame to Mountain View’s burrowing owl!

The Google Bus protesters have said that the company should build housing on its campus, but the Mountain View city council has explicitly forbidden Google from doing just that. They’ve argued that it’s to protect the city’s burrowing owl population. (The city council even created a feral cat taskforce last week to protect the owls.)

Even more mind-bogglingly, Mountain View is discussing new office development that would bring as many as 42,550 office workers to the city. But the city’s zoning plan only allows for a maximum of 7,000 new homes by 2030.Â

Then, if you look at the job-to-housing ratios in some of the other peninsula cities like Palo Alto, it’s pretty terrible. Palo Alto voters just killed an affordable housing development for seniors by ballot measure last November.

So the wealthy voting classes of the peninsula are also strangling themselves of housing too. The median rent in Mountain View is $2,700 compared to $3,400 in San Francisco, according to Zillow. Once you factor in the cost of owning a car â€" estimated at slightly more than $9,000 a year by the AAA â€" it’s not that much cheaper.

If you look even closer to the Caltrain stations, rents go way up. The newly-opened Madera complex in downtown Mountain View rents out 1-bedroom units starting at $3,299 all the way up to 2-bedroom apartments at $8,000 per month.

Certain cities like Menlo Park seem more collaborative. Facebook partnered with developer St. Anton Partners to build a 394-unit complex within walking distance of its Menlo Park headquarters. But that’s 394 units for a company with more than 6,000 employees.

So one contributor to the tech industry’s spread into San Francisco is that the peninsula cities are more than happy to vote for jobs, just not homes.

2) Why is the tech industry migrating to cities anyway?

This is a demographic shift that is much larger than the technology industry itself â€" although there are some tech-specific reasons that have fueled a migration north from the historic heart of Silicon Valley over the last 10 years.

This is what urbanist Alan Ehrenhalt calls “The Great Inversion,â€Â a major shift where cities and suburbs have traded places over the last 30 to 40 years. As people marry later and employment becomes more temporal, young adults and affluent retirees are moving into the urban core, while immigrants and the less affluent are moving out.

San Francisco’s population hit a trough around 1980, after steadily declining since the 1950s as the city’s socially conservative white and Irish-Catholic population left for the suburbs. Into the vacuum of relatively cheaper rents they left behind, came the misfits, hippies and immigrants that fomented so many of San Francisco’s beautifully weird cultural and sexual revolutions.

But that out-migration reversed around 1980, and the city’s population has been steadily rising for the last 30 years.

This is a phenomenon that’s happening to cities all over the United States.

It’s happening in Seattle, Atlanta, New York City, Boston and Washington. D.C.:

Its rapacious speed may even be accelerating. Witness hyper-gentrification in Brooklyn and Manhattan, or the “Shoreditch-ification†of London.

Why?

People are getting married later and are living longer. Nearly 50 percent of Americans, or more than 100 million people are unmarried today, up from around 22 percent in 1950.

The job market has changed as well. In 1978, the U.S.’s manufacturing employment peaked and the noise and grit of the blue-collar factories that once fueled the flight of the upper-middle-class disappeared. These vacant manufacturing warehouses turned into the live-work spaces and lofts that emerged in the 1980s and 1990s in cities like New York and San Francisco.

The concept of lifetime employment also faded. Today, San Francisco’s younger workers derive their job security not from any single employer but instead from a large network of weak ties that lasts from one company to the next. The density of cities favors this job-hopping behavior more than the relative isolation of suburbia.

There are also some tech industry-specific reasons too. The capital costs required to found a company and launch a minimum viable product are much lower than a decade ago. Startups also need fewer people, especially with the low distribution costs provided by platforms like Apple’s iOS app store or Facebook. So it’s easier for lots of small companies to find pockets of commercial real estate in the city for new offices. It’s also easier for VCs to fund an order of magnitude more experiments, even if the same proportion of them fails.

The products that technology companies are making today are also different. In the 1970s, “Silicon Valley†literally meant making semiconductors in large fabs that required expensive equipment and clean rooms.

But the big wave of the last decade has been social networking. And every notable consumer web or mobile product of this wave has been seeded through critical mass in the “analogâ€Â world. Facebook had university campuses. Snapchat had Southern California high schools. Foursquare had Lower Manhattan. Twitter had San Francisco. These products favor social density.

An even newer generation of startups addresses distinctly urban questions. Airbnb exists because in 2007, San Francisco didn’t have enough hotel capacity to house visitors in town for an industrial design conference. Uber exists because the city’s taxi market was under-supplied with drivers and smartphones offered a new way of summoning transportation on demand. Then there are very young startups like Campus, which is like a venture-backed communal living movement, Leap Transit, which is trying to shake up scheduled transport, or any of the companies out of Tumml, an urban ventures incubator.

As tech workers have moved into cities, the industry has changed San Francisco’s culture and San Francisco has changed the technology industry.

Nevertheless, while tech is fueling San Francisco’s current boom and has helped cut the city’s unemployment rate by about half since 2010, this gentrification wave has been going on for decades longer than the word “dot-com†has existed.

And it’s happening all over the country.

So a great question of our time is how American cities handle this shift. They have to do this in the face of global economic changes that are dividing our workforce into highly-skilled knowledge workers who are disproportionately benefiting from growth and lower-skilled service workers that are not seeing their wages rise at all.

3) OK, let’s build more housing!

Y Combinator partner Garry Tan tweeted out a map the other week:

Wouldn’t that be simple?

But it’s not that easy. While the real estate market is hot, developers are currently building 6,000 units.

To go beyond that, you have to build political will.

You have to win hearts and minds.

You have to make sure that people don’t get pushed out or left behind.

San Francisco’s orientation towards growth control has 50 years of history behind it and more than 80 percent of the city’s housing stock is either owner-occupied or rent controlled. The city’s height limits, its rent control and its formidable permitting process are all products of tenant, environmental and preservationist movements that have arisen and fallen over decades.

Even back in 1967, thousands of Latino residents in the Mission â€" the heart of the gentrification battle today â€" organized and convinced the city’s Board of Supervisors to vote down an urban renewal program in the neighborhood. They saw what happened to the Fillmore â€" once the “Harlem of the West†â€" when the city’s re-development agency razed it, displacing tens of thousands of black residents and the businesses they had created after World War II.

To this day, there’s distrust and fear that the same thing will happen again, especially if it’s carried out by private developers. Advocacy group Causa Justa has been documenting this displacement through Census data, noting that the Mission has lost 1,400 Latino households while adding 2,900 white households between 1990 and 2011. In the same time period, Oakland lost 40 percent of its black residents.

During the first tech boom, there was the Mission Anti-Displacement Coalition, which pushed for a moratorium on new market-rate housing and live-work lofts in the neighborhood. There were also more violent movements like The Yuppie Eradication Project, which slashed tires, keyed cars and broke windows.

Throughout the years, these movements have found alliances with other neighborhood organizations, preservationist and environmental interests.

There were struggles in the 1950s and 60s to stop freeways from cutting through the Panhandle and Golden Gate Park, which gave way to another slow growth political movement in the 1970s to push back on downtown high-rises as they encroached into North Beach and Chinatown. In 1986, the city passed a resolution to control the amount of new commercial real estate space that could be built in any single year.

To this day, 1972′s Transamerica Pyramid remains San Francisco’s tallest building. It’s only in 2017 that a taller 1,070-foot tower anchored by Salesforce will open.

As political scientist and longtime San Francisco observer Richard DeLeon puts it:

San Francisco has emerged as a “semi-sovereign city†â€" a city that imposes as many limits on capital as capital imposes on it. Mislabeled by some detractors as socialist or radical in the Marxist tradition, San Francisco’s progressivism is concerned with consumption more than production, residence more than workplace, meaning more than materialism, community empowerment more than class struggle. Its first priority is not revolution but protection â€" protection of the city’s environment, architectural heritage, neighborhoods, diversity, and overall quality of life from the radical transformations of turbulent American capitalism.

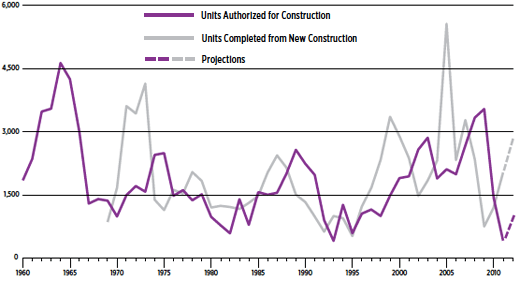

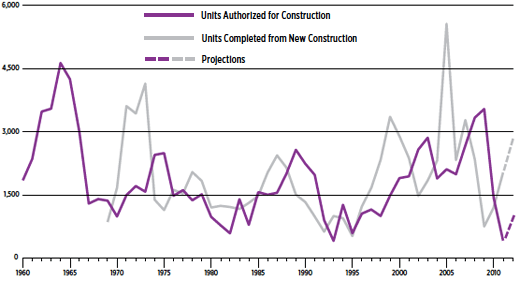

While we have to thank these movements for preserving so much of the land surrounding San Francisco and the city’s beautiful Victorians, one side effect is that the city has added an average of 1,500 units per year for the last 20 years. Meanwhile, the U.S. Census estimates that the city’s population grew by 32,000 people from 2010 to 2013 alone.

Even today, you can see these factions engaging in behavior that might seem absurd in the context of a housing shortage.

Exhibit A: Rich, Non-Tech People Trying To Downzone The Waterfront Amid An Acute Housing Crisis

On the ballot this June, is an initiative that will require voters to individually approve height limit exemptions for developments on the city’s waterfront. It jeopardizes three major projects including the Warriors stadium (pictured below) and a plan to turn Pier 70 into a mixed-use development with office space and apartments.

Those developments are slated to deliver as much as 3,690 housing units and $124 million in affordable housing fees, according to a memo written by John Arntz, the director of the city’s department of elections. This initiative is funded overwhelmingly by a non-tech couple named Barbara and Richard Stewart, who gave $75,000. (They did not reply to requests for comment.)

It is overwhelmingly expected to pass, so even the mayor isn’t taking a position on it.

“Would you like free ice cream San Francisco? ‘Why yes I would,’ †is how one political consultant summed up Prop. B’s voter appeal to John Cote at the San Francisco Chronicle. “Why stand up against something where 60 to 70 percent are going to vote with the other side?â€

No. This is not free ice cream!

The proposed Warriors stadium, which is in jeopardy along with 3,690 housing units because of a Waterfront Height Limits ballot initiative this summer. (From the NBA)

Exhibit B: Protests Against New Housing Developments That Don’t Get Rid Of Any Existing Housing

You’ll also end up seeing demonstrations like this one at 16th and Mission, which protest a proposed 351-unit condominium development that replaces a Walgreens and a Burger King. It does not remove any existing housing or directly displace anyone.

At face value, this might not make sense. But there are a couple reasons that this happens. One is that gentrification raises the gap between market-rate rents and rent-controlled rents, strengthening the financial incentive for landlords to evict longtime tenants.

Two is that neighborhood organizations representing historically disenfranchised groups have used San Francisco’s byzantine planning process to win concessions from the city’s development elite for the last 30 to 40 years.

Unlike the wealthy waterfront NIMBYists, these communities are at risk of being displaced. If they don’t speak up for themselves, who will?

Will you?

Look at Vida on Mission Street, which is a fancy new mixed-use building slated to open up next January (pictured below).

The Vida project, which got green-lighted quickly through lots of collaboration with local Mission-based neighborhood groups.

As Lauren Smiley wrote in San Francisco magazine last month, when developer Dean Givas wanted to build luxury condos in the heart of the Mission District, he bent over backward for local community groups to get the project quickly green-lighted.

Over two years of negotiations with community groups, Givas agreed to buy a plot on nearby Shotwell Street for the city to develop 40 units of affordable housing, dwarfing the 14 units that would have been required within the Vida building. He was already on the hook to pay $1.4 million in city-mandated impact fees, yet the community got him to agree to much more. He donated $150,000 to a fund to help mom-and-pop Mission businessesâ€"to be buoyed with a sales tax on future condo sales.

Then, in what the project’s attorney called an unprecedented move by a developer in the Mission, he donated $650,000 to 23 community groups, a strategy that drew sellout criticisms from purists in the nonprofit community and shakedown charges from pro-development forces worried that his philanthropic palm greasing would set a precedent. Next, Givas donated $1 million for the Texas-based Alamo Drafthouse Cinema chain to renovate the long-shuttered New Mission Theater next door into a five-screen dinner-and-a-movie cineplex. The Texans agreed to hire 50 percent of its staff from the neighborhood and to let nonprofits host at-cost benefits at the facility.

In principle, it’s fine to use the levers of urban politics to redistribute the wealth an economic boom creates in San Francisco.

But these concessions are being negotiated housing development by housing development, which slows the city’s ability to produce housing â€" both market-rate and affordable â€" at scale.

Mayor Ed Lee and others are trying to speed this up, by giving affordable housing projects first priority in the planning department’s approval process, followed by market rate projects with a higher inclusionary percentage of below-market-rate housing.

It’s a good first step, but….

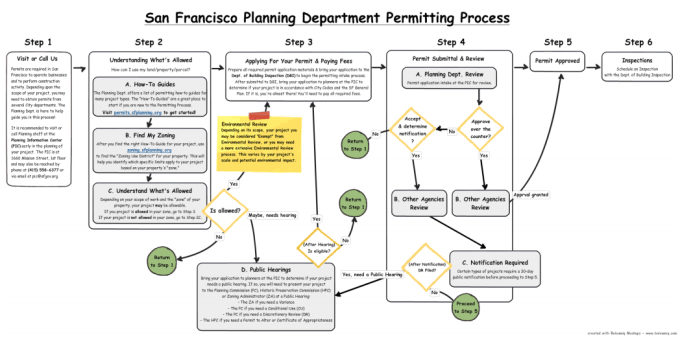

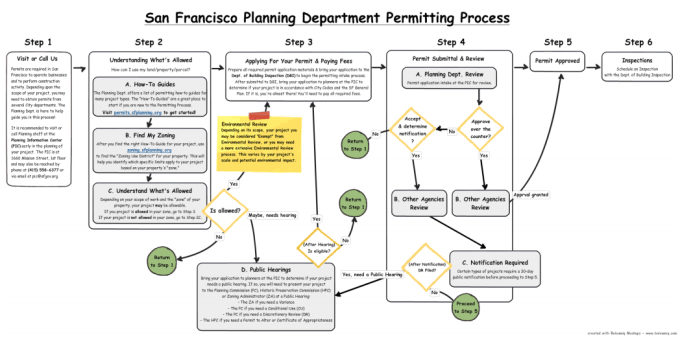

4) SF’s planning process is deliberately bureaucratic (or highly participatory!) for political reasons:

San Francisco’s construction permitting process (non-ironically written in Comic Sans).

One of the things that makes housing development different in San Francisco compared to other major U.S. cities is that building permits are discretionary rather than as-of-right. In other cities, if a developer already matches the existing zoning and height restrictions of the city plan, they can get issued a permit relatively quickly.

But for new housing developments in San Francisco, there’s a preliminary review, which takes six months.

Then there are also chances for your neighbors to appeal your permit on either an entitlement or environmental basis. The city also requires extensive public notice of proposed projects even if they already meet neighborhood plans, which have taken several years of deliberation to produce. Neighbors can appeal your project for something as insignificant as the shade of paint, although the city’s planning department and commission tries to get through minor appeals quickly.

If those fail, neighborhood groups can also file a CEQA or environmental lawsuit under California state law, challenging the environment impact of the project. Perversely, CEQA lawsuits have been used to challenge a city plan to add 34 miles of bike lanes.

Then if that fails, opponents can put a development directly on a citywide ballot with enough signatures. (Thanks, Hiram Johnson?) That’s what happened with the controversial 8 Washington luxury condo project last November even though it had already gone through eight years of deliberation.

These barriers add unpredictable costs and years of delays for every developer, which are ultimately passed onto buyers and renters. It also means that developers have problems attracting capital financing in weaker economic years because of the political uncertainty around getting a project passed.

The sophistication with which neighborhood groups wield San Francisco’s arcane land-use and zoning regulations for activist purposes is one of the very unique things about the city’s politics.

But the city’s political leadership doesn’t want to change it, because it fears backlash from powerful neighborhood groups, which actually deliver votes.

5) Also, parts of the progressive community do not believe in supply and demand.

Yeah, I was surprised by this.

“We can’t build our way to affordability,†is a common refrain. Tim Redmond, who used to edit the San Francisco Bay Guardian, even suggested today that the government should take 60 percent of the city’s housing off the private market over the next 20 years. (I have no idea how you would fund this.)

Several activists also sent me this paper, authored by Calvin Welch, of the Council of Community Housing Organizations.

SF Controller Shows Supply and Demand Does Not Work

Admirably, Welch has been fighting for affordable housing in San Francisco for the last forty years and is part of the politically powerful Haight Ashbury Neighborhood Council, which has seen that neighborhood through, well, everything.

But this paper conflates correlation with causation. He argues that when there is a decline in new housing units, there is also a decline in price.

Namely, he points to 2001 and 2002, while brushing off the mega-gigantic-enormous confounding variable of the dot-com bust and a regional recession.

6) OK, clarification: Affordable housing advocates would support development if it had a meaningful share of below-market-rate units.

So I met Welch and he made good points. (He’s been working on this for nearly forty years.)

His organization, the Council of Community Housing Organizations, argues that raw, additional construction will not make housing more affordable to working-class or lower-income San Franciscans. Left to its own devices, the market will only produce housing that chases the very richest buyers. In a time of rising inequality, those market-rate units are increasingly out of reach, even for middle-class San Franciscans.

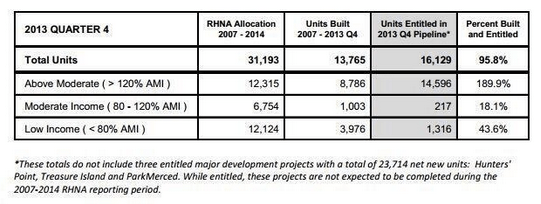

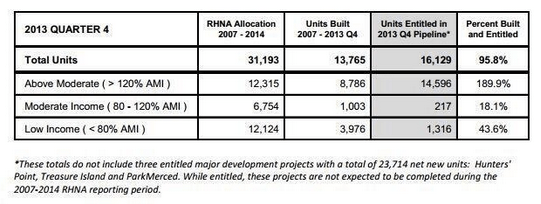

He points to tables like this one, which shows San Francisco’s residential housing pipeline for the last quarter of 2013. Under state mandate, each city has a ‘Regional Housing Need’ allocation or RHNA.

In San Francisco, the market is producing almost double the number of housing units for people with ‘Above Moderate’ incomes, or 120 percent of the area’s median income, as the RHNA says it needs to build.

So affordable housing advocates say that developers should be required to have a higher percentage of below-market-rate units built. The issue with inclusionary housing is that construction costs are so high in San Francisco â€" calculated here to be nearly $500,000 for an 800-foot square unit â€" that affordable housing requires generous public subsidies.

The Mayor’s Office of Housing and Community Development says there are 1,759 units of affordable housing that are currently being built or preserved at a cost of $824.5 million. About $274.1 million of that funding is coming from the city, and the remaining $550.3 million has to come from somewhere else.

The federal and state government used to help with this, but their assistance has dropped off dramatically since the 1980s. (Cuts to the federal Housing and Urban Development department budget under the Reagan administration coincided with the rise of urban homelessness in San Francisco.)

When below-market rate units do get built, the lines are massive: 2,800 people applied for the 60 units at this SOMA affordable housing development.

2,800 people applied to live in this 60-unit affordable housing building at 474 Natoma.

Also, inclusionary housing has its own trade-offs. It can pass on the costs of building below-market-rate units to market-rate buyers, cutting out units that would be affordable to middle-class buyers. Hence, another reason for the disappearance of the San Francisco’s middle-class.

You’ll see in the table above that the market is mostly producing housing for ‘above moderate’ incomes, then some ‘low income’ housing units, but hardly anything for ‘moderate incomes.’ The lack of options for middle-class San Franciscans in turn feeds the two-tier systems that we’re seeing in transportation with MUNI-versus-Uber and in education, where 30 percent of the city’s students go to private schools at $30,000 per year while the public school system will see almost all of its enrollment growth coming from public housing over the next three decades.

Pro-development advocates like the non-profit SPUR tend to say that market-rate construction will alleviate demand for the city’s existing housing stock. (They still supporting inclusionary housing though.)

Meanwhile, supervisor Jane Kim, who represents the Tenderloin, is pushing legislation that aims for a ratio of 30 percent below-market-rate housing to 70 percent market-rate housing.

SPUR says that ratio means the math will no longer work out for developers, meaning they’ll lose money by default, so they won’t build at all. Over the past decade, the city had carefully negotiated a requirement for developers to either build 12 percent affordable housing on-site for projects with more than 10 units or 20 percent off-site or the equivalent of 20 percent into a city fund.

7) Yet we’re arguing over shades of gray. Sorry, supply and demand still totally matter.

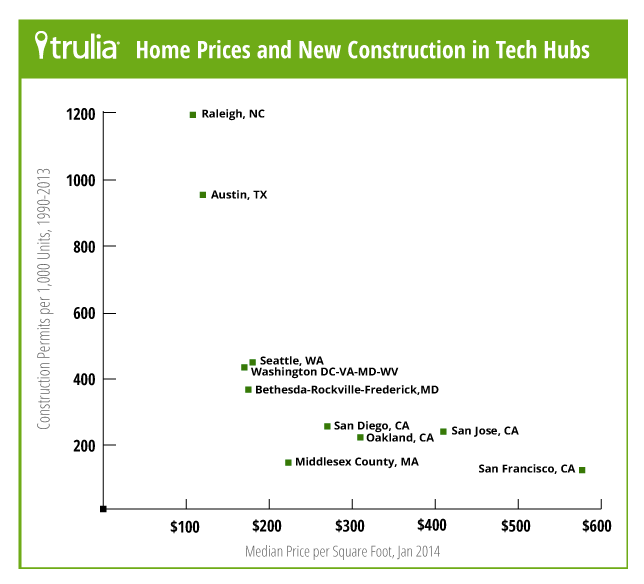

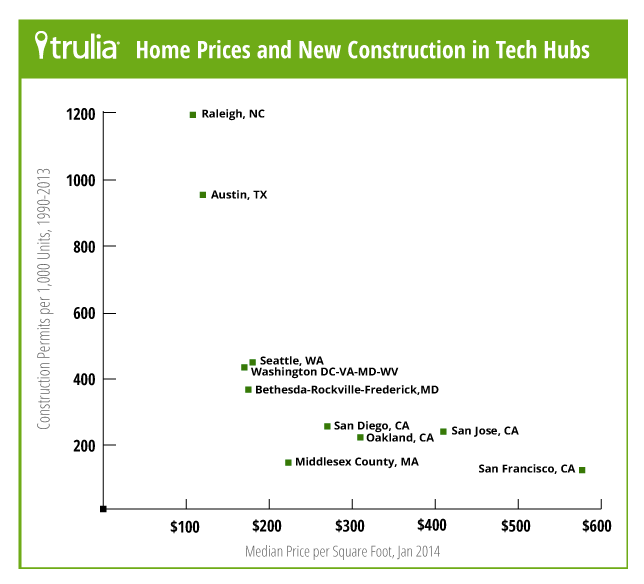

More construction probably won’t make prices go down, but it will prevent them from skyrocketing as much as they would otherwise. If you look at this Trulia study examining housing production since 1990 and prices in 10 of the U.S.’s biggest tech hubs, you’ll see that San Francisco had the highest median prices per square foot and had the lowest number of new construction permits per 1,000 units between 1990 and 2013.

There are also many long-term studies like this one or this one or this one from economists like Edward Glaeser of Harvard University and Joseph Gyourko at the University of Pennsylvania examining the impact of land-use restrictions and zoning on U.S. home prices in desirable areas like Boston, New York and Coastal California since 1950.

They found that in most parts of the country, home prices are at or near the raw costs of construction. (As of February, the median U.S. home price is $261,800.)

But in places where zoning regulations create artificial limits on home production, the final prices to home buyers jump far above construction costs. In the 1980s and 1990s, they found that virtually all of San Francisco’s home prices were at least 140 percent above base construction costs.

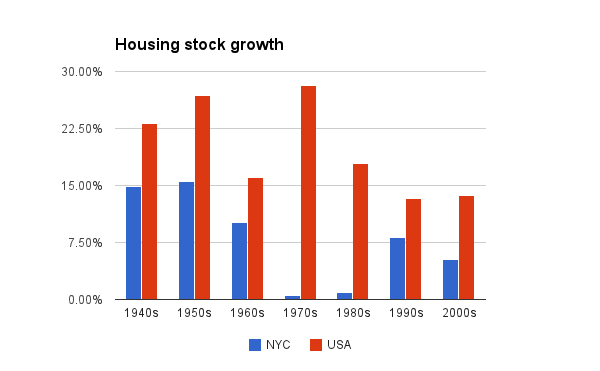

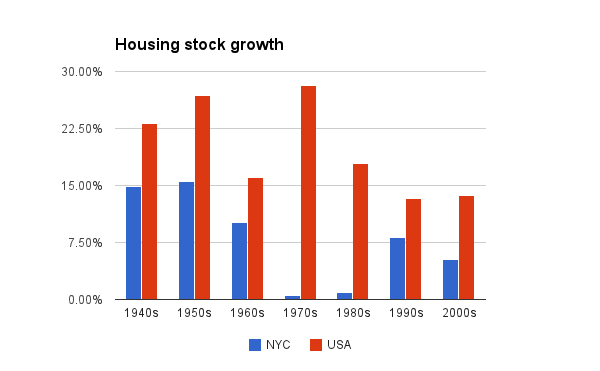

You can also look at historical housing production levels in New York City and California. Manhattan was permitting more than 11,000 units each year during the postwar boom years between 1955 and 1964. But between 1980 and 1999, the New York City borough was permitting just an average of 3,120 units per year. Between 1970 and 2000, the median price of a Manhattan housing unit increased by 284 percent in constant dollars.

Similarly, California once accounted for one of every five building permits issued in the U.S. during the 1960s. That construction rate slowed down, and real housing prices in the state have increased by 385 percent from 1970 to 2010.

Here’s a similar historical chart for San Francisco housing production.

It’s as if both cities reacted 10 or 20 years late â€" long after the Great Inversion started and before anybody had any idea about how big or transformative this suburban-urban migration would become.

This issue is profound. Regional economic booms normally benefit all workers by creating more jobs throughout the economy â€" supporting locally-owned businesses and bringing in more tax revenue for public services. Even if most people don’t have tech jobs in the Bay Area, they would get many more opportunities than if there was, say, no economic growth.

The point is that if the entire Bay Area had a more elastic housing supply, it would not only make living affordable for most people, it would allow a far larger portion of the population to find jobs and do things like save or spend money instead of moving somewhere distant and spending their money on driving, or even being unemployed.

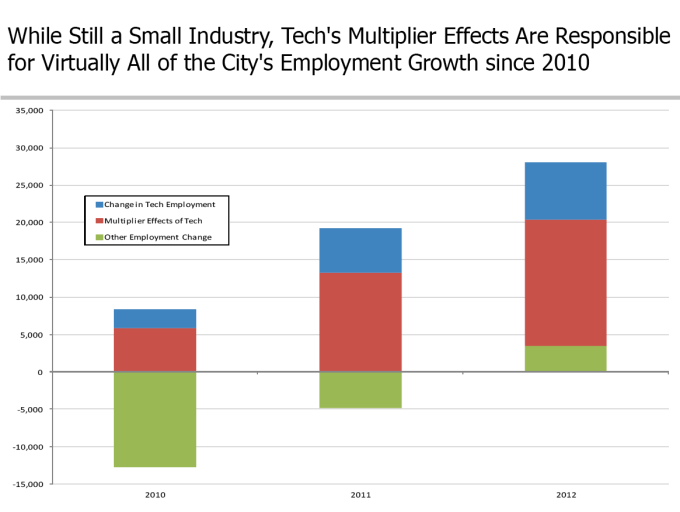

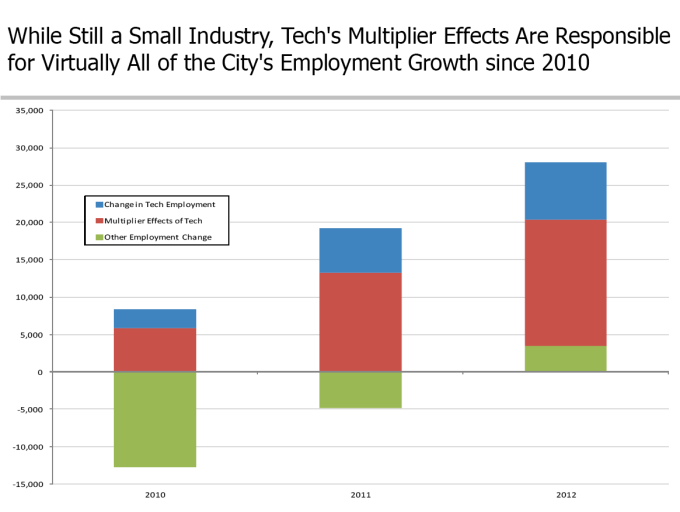

UC Berkeley economist Enrico Moretti calculated that a single tech job typically produces five additional local-services jobs.

But in San Francisco, that spillover effect is much smaller. This is in no small part because so much of our incomes end up going toward housing costs. The city’s economist Ted Egan estimates that each San Francisco tech job likely creates somewhere slightly north of two extra jobs, not five.

San Francisco’s city economist, Ted Egan, argues above that the tech industry and its spillover effects have been responsible for virtually all of the city’s job growth since 2010. Still, the multiplier effect in San Francisco at slightly more than 2 jobs created for every single tech job, is much lower than the 5-to-1 ratio UC Berkeley economist Enrico Moretti calculated nationwide. Housing costs dampen the spillovers since people end up spending so much more on rent and mortgages.

However, it’s hard to have even basic debates over modest increases in the housing supply here because of this ideological dispute.

8)Â 1978 and 1979: Proposition 13 and Rent Control

I keep coming back to the late 1970s because both the city of San Francisco and the state of California made choices that have had enduring impacts on housing to this day.

If the San Francisco seems torn apart by class war today, the city was in profound agony in 1978.

A charismatic, religious leader named Jim Jones had won the favor of city’s political elite and helped deliver the mayorship to George Moscone. Amid emerging allegations of physical abuse, Jones and hundreds of his followers defected from San Francisco to Guyana, where he sought to build a utopia.

Instead, he convinced more than 900 of his followers, including mothers and infants, to ingest cyanide mixed with punch in a mass suicide. It was an enormous tragedy for the city; nearly every family in the black Fillmore district knew someone they had lost in Jonestown.

Then, just nine days later, there was a double blow. Supervisor Dan White murdered mayor Moscone and gay political icon Harvey Milk in the heart of San Francisco’s beaux-arts City Hall. Tens of thousands of grief-stricken people marched down Market Street in a candlelight vigil.

It was into this chaos that Dianne Feinstein, who had recently been widowed after her husband passed away from colon cancer, stepped into power and assumed mayorship.

The broader U.S. economic picture was not great. Inflation shot from 9 percent at the time Feinstein became mayor to 13.3 percent a year later as the Iranian revolution triggered another energy crisis. Gas lines formed once again around stations throughout the country â€" again, prompting another cultural re-consideration of suburban ideal.

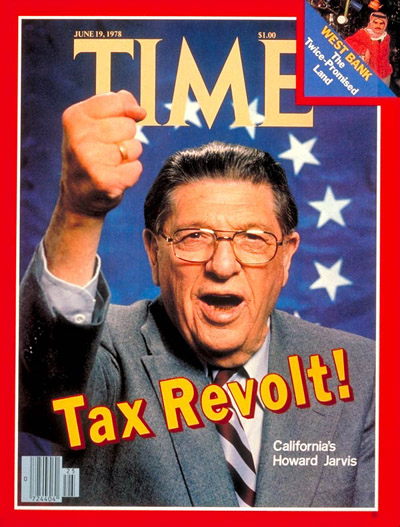

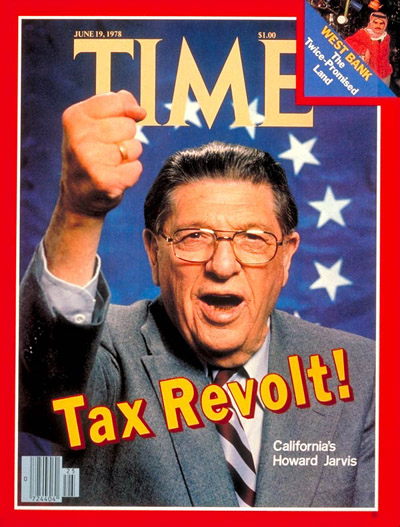

Earlier in the summer of 1978, a cantankerous former small-town newspaper publisher named Howard Jarvis led a “taxpayer revolt†as property prices were soaring, threatening to throw home owners out of their homes because of rising tax bills. Jarvis’ idea was to cap property taxes at 1 percent of their assessed value and to prevent them from rising by more than 2 percent each year until the property was sold again and its taxes were reset at a new market value.

Howard Jarvis launched the taxpayer revolt that got Proposition 13 passed, capping property taxes for homeowners.

One argument that Jarvis used to rally tenant support for Proposition 13, was that he promised that landlords would pass on their tax savings to renters.

They didn’t. They pocketed the savings for themselves.

Tenants were furious, and rent control movements erupted in at least a dozen cities throughout California, from Berkeley to Santa Monica.

San Francisco might have gone a different way, but Angelo Sangiacomo was the alleged trigger. The Italian-American landlord, who was born and raised in the Richmond District, demanded across-the-board rent increases of 25 to 65 percent in seventeen hundred apartments in March of 1979.

Amid the outrage, Feinstein pushed for a 60-day rent freeze that would ward off the rise of a tenant-backed mayoral challenger.

Both policies have had far-reaching and unanticipated ripple effects.

Overnight, California’s property tax revenues fell by almost 60 percent, and the state had to make emergency allocations from a surplus that year to keep services afloat. Because the state’s K-12 schools are financed largely by property taxes, California’s spending per student fell from 5th in the nation in the mid-1960s to 50th in this decade.

Without the ability to rely as heavily on property taxes, city governments throughout the state had to favor office and retail development over housing in order to boost sales taxes. It may have even accelerated the homogeny of suburbs as smaller city governments had to cut deals to attract “big box†retailers to boost sales tax revenue, crowding out independently-run stores.

It also created a lock-in effect as California property values soared, creating a bigger gap in property taxes on newly-sold properties and ones that homeowners had held onto for a long time. That rigidity further enhanced the political power that NIMBY-ist homeowners accumulated in suburban city councils throughout the state.

San Francisco’s 60-day rent control ordinance also stuck around, and it was subsequently strengthened through the following decades. The maximum allowable annual rent increase went from 7 percent to 4 percent in mid-1980s and then to a fraction of the inflation rate set by the Rent Board in 1992.

Because both Proposition 13 and rent control insulate homeowners and rent-controlled tenants from dramatic tax or rent increases when the market undersupplies housing, they undermined political will for building homes. Both of these policies were enacted just as the “Great Inversion†started.

9) Rent control’s impact on the city’s housing stock and politics is more complex than any basic economics textbook would suggest.

Rent control is a naturally divisive topic in the tech community. Progressives view it as a sacred right that protects the remnants of a working- and middle-class in the city. “It’s a non-renewable resource,â€Â Erin McElroy, who runs the Anti-Eviction Mapping Project, explained to me.

But the tech community is both socially liberal and market-oriented, with more than 90 percent of political donations from Apple and Google employees going to Barack Obama in the last election. So price controls in the name of community stability and equity just makes people’s brains explode.

Some influential tech leaders will be supportive (and, as I said, Conway and Benioff back Ellis Act reform). Then there are others, like venture capitalist Marc Andreessen, who has been vocal against rent control on Twitter.

Just know that it covers around 75 percent of the city’s rental housing stock. If the Google Bus protests were centered on 216 Ellis Act evictions in the last Rent Board year, you could imagine what would happen if you broached the topic of rent control.

Want to alienate about half of San Francisco? Have fun.

Yes, rent control is a blunt instrument of income re-distribution in an increasingly unequal world. It is not means-tested, meaning anyone from well-salaried, white-collar workers to very low-income residents can benefit from it. It also forces a number of small-time, mom-and-pop landlords to individually subsidize someone else’s cost of living in the city.

It creates two classes of tenants â€" one that is very legally protected and another that is not. For market-rate tenants, there is no law compelling their landlords to give them as much as $44,842 in relocation expenses under new city legislation like they will for Ellis Act evictees if they raise rents beyond what they can afford.

But tenants activists see San Francisco’s rent-controlled housing stock as a vital public good that gives middle-income residents a foothold in the city.

And while the make-up of the city’s rent-controlled hasn’t been studied in more than a decade, it likely contains less-wealthy San Franciscans on average than the market-rate units do. In studies of other cities where rent control unexpectedly ended via a change in state law like Cambridge, Massachusetts, tenants in these apartments had lower incomes than those of market-rate renters.

San Francisco’s version of rent control also does not apply to buildings constructed after 1979, so it shouldn’t dis-incentivize developers from producing new units.

Instead, a lot of other factors are constricting supply. That said, I do think it undermines the political will that would otherwise exist for building more housing.

10)Â So a highly-restricted housing supply +Â rising demand + a volatile local economy prone to booms and busts + strict rent control without vacancy control = Eviction crisis every decade!Â

San Francisco’s version of rent control lacks vacancy controls, which means landlords can re-set rents at whatever the market will bear when new rent-controlled tenants move in.

The logic is that with vacancy controls, landlords won’t invest in maintaining their properties. But the flipside is that the landlord also has a strong financial incentive to evict longstanding tenants who are paying below-market rates.

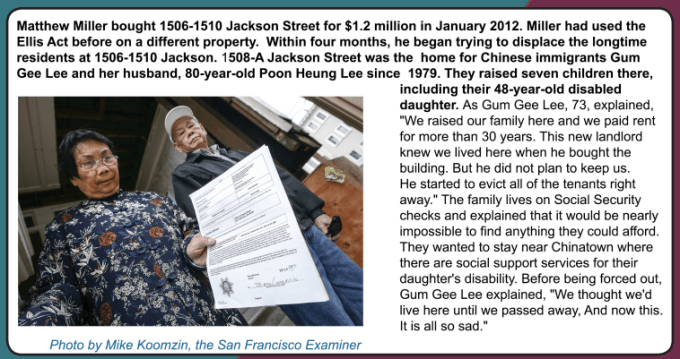

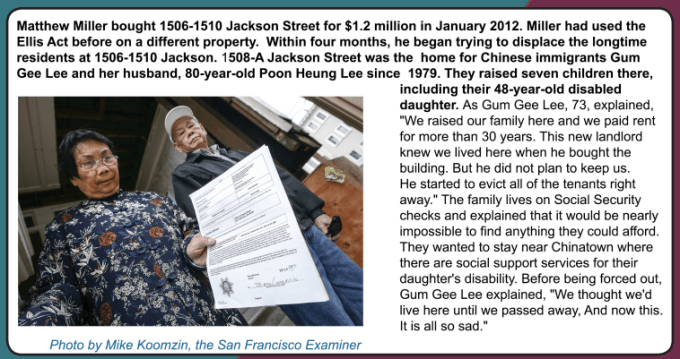

So every decade during a boom, there is a tragic, elderly face for the story of displacement.

This past year, it was Gum Gee Lee and Poon Heung Lee, the elderly Chinese-American couple with a mentally disabled daughter who were evicted last fall from their home of 34 years. But back in the 1990s, there was Lola McKay. A year after her eviction fight started, McKay died alone in her Mission apartment of 42 years at age 83 in 2000.

It sucks. I sat in a high school gym in the Tenderloin full of terrified elderly and disabled people at the citywide tenant convention.

11) What is the Ellis Act?

At the heart of the Google Bus protests are a specific kind of eviction called an Ellis Act eviction.

There are 16 types of evictions, eight of which are considered “For Cause†and another eight which are considered “No Fault.â€

The Ellis Act is one of these. While it’s hard to fight a surge in other kinds of no-fault evictions like “Owner Move-In†evictions, the tenants movement has a stronger moral upper hand with the Ellis Act.

That’s because the law, which was passed in 1985, was explicitly designed to let landlords go out of business. Tenants activists say that the Ellis Act is instead abused by real estate speculators, who evict their tenants, turn these rent-controlled apartments into tenancies-in-common and sell them at a profit.

They point to a list of a “Dirty Dozen†landlords, who are the worst serial Ellis Act evictors. One of them is Urban Green Investments, which is evicting 98-year-old Mary Elizabeth Phillips and Balboa High School teacher Sarah Brant, who live up my street.

Phillips moved to the city in the late 1930s as a war bride and moved into this 1950s-era apartment building on Dolores Street, across the way from what is now a huge apartment complex containing a brand-new bottom-floor Whole Foods Market.

Her last day was supposed to be six days ago on April 8. But she’s still there, at least until the sheriff receives a court order to take action. At 98, she has nowhere to go.

98-year-old Mary Elizabeth Phillips and Balboa High School teacher Sarah Brant are being evicted from their apartments in the Mission District by Urban Green Investments. Phillips’ last day was supposed to be six days ago. She doesn’t have anywhere to go and doesn’t have enough money to afford current market-rate rents in San Francisco. Brant, her neighbor, helps care for her. (From VanishingSF)

The city government is trying to respond as quickly as it can, but it can only do so much because the Ellis Act is state law.

Earlier this week, city supervisor David Campos, who represents the other part of the Mission, pushed legislation through the Board of Supervisors that would raise compensation for Ellis Act evictees. It’s going from $5,200 per tenant to the difference between the tenant’s current rent and the market-rate rent for a comparable apartment over two years. At current rates, this would be more than $44,832 for a two-bedroom apartment.

They’re trying to change the law at the state level too. Mark Leno, who represents San Francisco in the California State Senate, also introduced a bill that would require landlords to hold a property for five years before invoking the Ellis Act to evict tenants. It just passed the Senate Transportation and Housing Committee earlier this week.

12) Fuck, this is complicated. Anti-tech sentiment becomes a catalyst.

Tenants-rights activists had struggled to generate momentum for protections against Ellis Act evictions, but villains like real-estate speculators are too nebulous. Indeed, many of the landlords responsible for the bulk of Ellis Act evictions hide behind strangely-named entities like ‘Pineapple Boy LLC.’

But the Google Bus protests worked.

They were a media sensation.

They tapped into this inchoate sense of frustration around everything from rising income inequality to privacy to surveillance to the environmental impact of the hardware we buy to a dubious sense that today’s leading technology companies aren’t living up to their missions of not being evil.

“The we-hate-tech-workers is mostly a media narrative,†said organizer Fred Sherburn-Zimmer. “It’s not about that. It’s about income disparity. It’s about speculators using high-income workers to displace communities.â€

Sherburn-Zimmer acknowledged that the bus protests were a tactic. But she said, without them, the movement wouldn’t have been able to get 500 people to march in Sacramento for Ellis Act reform.

She also said that the support of Conway, the advocacy group he founded called sf.citi and other tech companies will be invaluable in turning votes on the peninsula to get Leno’s bill moving. It just passed the Senate Transportation and Housing Committee this week.

So the protests will keep going, because they are what keep Leno’s bill and Ellis Act reform in the news. (Don’t take it too personally. You can blame us â€" the media â€" for finding protests against globally-recognized brands like Google much sexier than protests against individual Mountain View city council members.)

13)Â Who are the protesters and what do they want?Â

Like the tech community itself, the activist community is pretty heterogeneous. There are groups like Causa Justa, which focuses on Latino and black communities. The are housing focused groups like the Housing Rights Committee and others affiliated with the San Francisco Tenants Union. There are efforts like the Anti-Eviction Mapping Project, which is asking San Franciscans to boycott renting at places where Ellis Act evictions have happened.

McElroy, who is crammed into a two-bedroom, non-rent-controlled apartment with four other people in Bernal Heights, built it. She’s been leading many of the protests several times a week at different real estate offices, Google Bus stops and homes where long-time tenants are being evicted.

The broad point here is that while tech-fueled economic growth can be good, gentrification carries enormous and often tragic costs for certain individuals and communities. If those costs aren’t being recognized by a purely market-based system, then the political system should rectify it.

“We implore tech to start talking to us. Come out into the streets with us. I don’t think it occurs to people that they can be a body too. People live in bubbles here,†McElroy said. “If you’re scared, what does that compare to people who are being forced out of their homes?â€

But there are times when it can seem hypocritical.

Rebecca Solnit, one of the most vocal critics of the Google Buses and gentrification in the Mission, ironically sold her apartment to a Google engineer in 2011.

Rebecca Solnit, the San Francisco novelist who called the Google Buses “alien overlords†in a widely read London Review of Books essay, sold her apartment to a Google engineer in 2011.

Or just weird.

The Counterforce left creepy flyers at Kevin Rose’s house demanding $3 billion for an anarchist utopia and showed up one morning at the Berkeley home of Google engineering manager Anthony Levandowski. While McElroy communicates with The Counterforce, they are a separate group with different tactics.

And it often feels like protests meant to stir meaningful discussion about income inequality, gentrification and housing veer off into misguided anger or hatred.

At an anti-eviction protest on

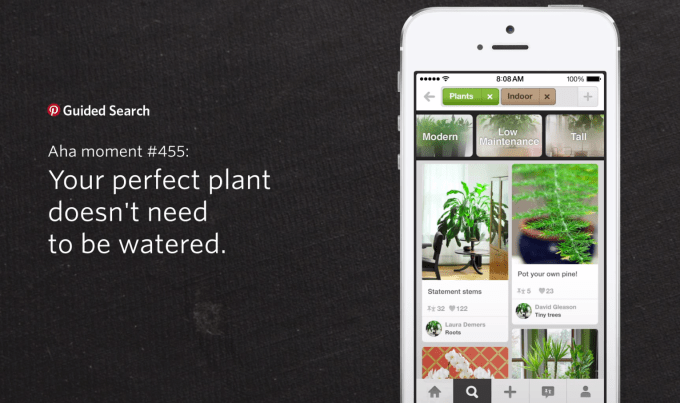

Custom Categories creates a dynamic feed of very specific topics, such as Bob Dylan. Silbermann described how the Pinterest team picked the traditional categories available from the homescreen  somewhat haphazardly and there was a lot of debate about what to offer next. Custom Categories allow you to “Choose Your Own Adventure†(the theme of the press event), finding categories that match your taste no matter how obscure.

Custom Categories creates a dynamic feed of very specific topics, such as Bob Dylan. Silbermann described how the Pinterest team picked the traditional categories available from the homescreen  somewhat haphazardly and there was a lot of debate about what to offer next. Custom Categories allow you to “Choose Your Own Adventure†(the theme of the press event), finding categories that match your taste no matter how obscure.

Mashfeed, on the other hand, lets you quickly find the right content from the accounts you want to follow.

Mashfeed, on the other hand, lets you quickly find the right content from the accounts you want to follow.