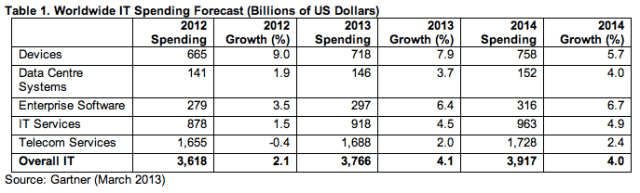

Gartner has just released its annual projections on worldwide IT spend over the next two years â€" arguably the analyst house’s most wide-ranging report covering sales in hardware, software, enterprise and telecoms. The overall trends continue to point up: globally we will see $3.8 trillion spent across all categories, a rise of 4.1% on 2012. That’s a sign of slight recovery on a year ago: growth in 2012 was only 2.1%. Mobile and enterprise services are fuelling a lot of the good news, with declines in areas of legacy technology like PCs and voice services. Gartner further notes that the same growth will largely continue into 2014.

Telecoms services will continue to account for the biggest proportion of IT spend, but they are also a sign of how times are changing. They will account for $1.69 billion of spend, nearly 45% of the total.

But within that, there are some declines as well as growth. Specifically, fixed voice services â€" which not only have been commoditized through competition, but are becoming less used by consumers who opt for mobile-only contracts â€" will continue diminish in size. Meanwhile, mobile data services, driven by trends in smartphone and tablet usage, continue to grow. These two trends will offset each other, resulting in “roughly flat†growth over this year and the next.

The rise of mobile is being felt in other categories, too.

Hardware sales â€" noted as “devices†in Gartner’s table below â€" will be the fastest-growing category this year, up nearly 8% to $718 billion, or 19% of all IT spend. PC sales, however, will be flat, and printer sales are in decline â€" another two signs of how there is some pain and woe still to come for some companies, especially legacy incumbents, in the tech world. (The current state of play with Dell being one specific sign of that.) Instead, the rise in devices is down to the impact of mobile, Gartner notes, and specifically the rise in smartphone usage, which has been so strong that Gartner actually raised its previous device forecast of 6.3% growth.

Gartner cautions that while nothing is going away soon, wider trends in mobile, cloud, social media and information management are affecting all categories of spend, which will have a knock-on affect in making some companies stronger, and some weaker, in the next several years:

“The global steady growth rates are a calm ocean that hides turbulent currents beneath,†writes John Lovelock, research vice president at Gartner. “The Nexus of Forces â€" social, mobile, cloud and information â€" are reshaping spending patterns across all of the IT sectors that Gartner forecasts. Consumers and businesses will continue to purchase a mix of IT products and services; nothing is going away completely. However, the ratio of this mix is changing dramatically and there are clear winners and losers over the next three to five years, as we see more of a transition from PCs to mobile phones, from servers to storage, from licensed software to cloud, or the shift in voice and data connections from fixed to mobile.â€

To give some more color device side, analysts at IDC yesterday released figures that estimate that this year some 60% of “smart connected devices†shipped in 2012 were smartphones, with that proportion rising to 67% by 2017. PCs, meanwhile, just under 30% of devices were PCs (desktop and laptop combined) in 2012, but with that number dropping down to a paltry 17% by 2017. Tablets will make up the difference, rising from 10.7% to 16% by 2017.

After devices, Gartner notes that enterprise software will be the second-biggest growth segment, up 6.4% to $297 billion â€" still making it a relatively small category at just under 8% of all IT spend. Gartner notes that database management systems, data integration tools and supply chain management are three growing areas, while IT operations management and operating systems are seeing “lower growth expectations.†Again, the shift away from these latter two categories are signs of some of the impact of cloud-based services, which take away both the need for on-premises management and software investments.

Release below.

Gartner Says Worldwide IT Spending on Pace to Reach $3.8 Trillion in 2013

Analysts to Discuss Latest IT Spending Outlook During Complimentary Gartner Webinar on 2 April

STAMFORD, Conn., March 28, 2013 â€" Worldwide IT spending is projected to total $3.8 trillion in 2013, a 4.1 per cent increase from 2012 spending of $3.6 trillion, according to the latest forecast by Gartner, Inc. Currency effects are less pronounced this quarter with growth in constant dollars forecast at 4 per cent for 2013.

The Gartner Worldwide IT Spending Forecast is the leading indicator of major technology trends across the hardware, software, IT services and telecom markets. For more than a decade, global IT and business executives have been using these highly anticipated quarterly reports to recognise market opportunities and challenges, and base their critical business decisions on proven methodologies rather than guesswork.

“Although the United States did avoid the fiscal cliff, the subsequent sequestration, compounded by the rise of Cyprus’ debt burden, seems to have netted out any benefit, and the fragile business and consumer sentiment throughout much of the world continues,†said Richard Gordon, managing vice president at Gartner. “However, the new shocks are expected to be short-lived, and while they may cause some pauses in discretionary spending along the way, strategic IT initiatives will continue.â€

Worldwide devices spending (which includes PCs, tablets, mobile phones and printers) is forecast to reach $718 billion in 2013, up 7.9 per cent from 2012 (see Table 1). Despite flat spending on PCs and a modest decline in spending on printers, a short-term boost to spending on premium mobile phones has driven an upward revision in the devices sector growth for 2013 from Gartner’s previous forecast of 6.3 per cent.

“The global steady growth rates are a calm ocean that hides turbulent currents beneath,†said John Lovelock, research vice president at Gartner. “The Nexus of Forces â€" social, mobile, cloud and information â€" are reshaping spending patterns across all of the IT sectors that Gartner forecasts. Consumers and businesses will continue to purchase a mix of IT products and services; nothing is going away completely. However, the ratio of this mix is changing dramatically and there are clear winners and losers over the next three to five years, as we see more of a transition from PCs to mobile phones, from servers to storage, from licensed software to cloud, or the shift in voice and data connections from fixed to mobile.â€

The outlook for 2013 for data center systems spending is forecast to grow 3.7 per cent in 2013, down 0.7 per cent from Gartner’s previous forecast. This reduction is largely due to cuts to the near-term forecast for spending on external storage and the enterprise in the economically troubled EMEA region.

Worldwide enterprise software spending is forecast to total $297 billion in 2013, a 6.4 per cent increase from 2012. Although the growth for this segment remains unchanged from Gartner’s previous forecast, this belies significant changes at a market level, as stronger growth expectations for database management systems (DBMS), data integration tools and supply chain management compensate for lower growth expectations for IT operations management and operating systems software.

While the outlook for IT services remains relatively unchanged since last quarter, continued hesitation among buyers is fostering hypercompetition and cost pressure in mature IT outsourcing (ITO) segments and reallocation of budget away from new projects in consulting and implementation.

The global telecom services market continues to be the largest IT spending market and will remain roughly flat over the new several years, with declining spending on voice services counterbalanced by strong growth in spending on mobile data services.

More-detailed analysis on the outlook for the IT industry will be presented in the webinar “IT Spending Forecast, 1Q13 Update: The Nexus of Forces Effect on Spending.†The complimentary webinar will be hosted by Gartner on 2 April 2 at 4:00pm UK time. During the webinar, Gartner analysts will look at where IT spending is headed in 2013. To register for the webinar, please visit http://my.gartner.com/portal/server.pt?open=512&objID=202&mode=2&PageID=5553&resId=2359126&ref=Webinar-Calendar.

Gartner’s IT spending forecast methodology relies heavily on rigorous analysis of sales by thousands of vendors across the entire range of IT products and services. Gartner uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data upon which to base its forecast. The Gartner quarterly IT spending forecast delivers a unique perspective on IT spending across hardware, software, IT services and telecommunications segments. These reports help Gartner clients understand market opportunities and challenges. The most recent IT spending forecast research is available at http://www.gartner.com/technology/research/it-spending-forecast/. This Quarterly IT Spending Forecast section includes links to the latest IT spending reports, webinars, blog posts and press releases.

Gartner Consulting provides fact-based consulting services that help their clients use and manage IT to enable business performance. Gartner’s 1,200 analysts and resarchers offer consulting services and advice to business executives in 80 countries. In addition, Gartner publishes original research and answers client questions.

No comments:

Post a Comment